Table of Content

With 30+ million users, 200+K experts and 200+ categories, Sulekha focuses on understanding the user need and matches it to verified service experts. Check with the lender if the property that you have shortlisted can be funded. Provide all the required legal and technical documents so that the lender can carry out the necessary due diligence. Check your credit score regularly to identify errors and get the same rectified. Since you would be required to upload the documents, please save them on your computer in a PDF format.

HDFC Bank commenced operations as a Scheduled Commercial Bank in January 1995. All the information contained herein above is for awareness and customer convenience and is intended to only act as an indicative guide about HDFC’s products and services. For detailed information about HDFC’s products and services kindly visit the nearest HDFC branch. HDFC disburses loans for under construction properties in installments based on the progress of construction. Every installment disbursed is known as a 'part' or a 'subsequent' disbursement. For home loans and balance transfer loans, the maximum tenure is 30 years or till the age of retirement, whichever is lower.

IFSC codes in Other Cities of Tamil Nadu

In fact, HDFC home loan rates are now above the rates it offered during the pre-pandemic period. Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. Post the fixed rate tenure, the loan switches to an adjustable rate.

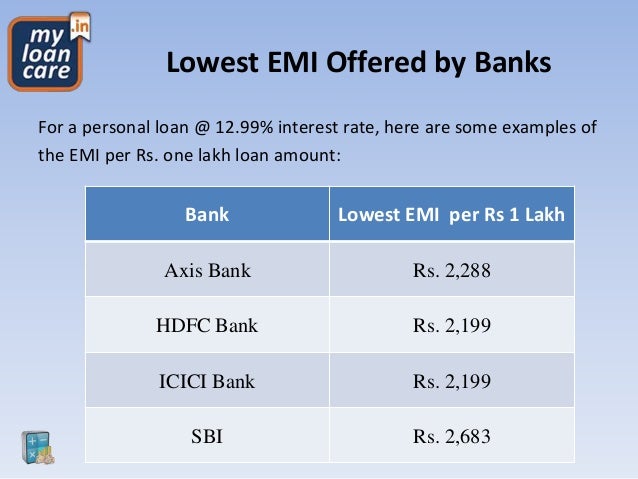

Home loans have one of the lowest interest rates as compared to other loan products such as auto loans and personal loans. Opt for a home loan provider who offers longer tenure loans, flexible repayment options etc. Interest rates may differ depending upon the loan amount, profession (salaried or self- employed) and your credit score among other factors.

Does the HDFC Bank, Kodambakkam branch have RTGS facility?

Ensure that you submit all the required documents as needed by the lender for loan processing. If you need any further details on the application process click here to read the FAQs. Under the ‘Basic information’ tab, select the type of loan you are looking for (home loan, home improvement loan, plot loans, etc.). You can click on the link beside the loan type for more information. Up to 1.50% of the loan amount or ₹4,500 whichever is higher, plus applicable taxes. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan.

This amount is paid during the period till the full disbursement of the loan. Your actual loan tenure — and EMI payments — begins once the Pre-EMI phase is over i.e. post the house loan has been fully disbursed. For your convenience, HDFC offers various modes for repayment of your house loan. Repayment of home loans is done through Equated Monthly Installments , which is a combination of interest and principal.

Latest in Tax

The country’s largest lender SBI offers a best rate of 8.75% for those with a credit score of 700 and above. ICICI Bank offers similar rates but its minimum credit score is 750. While adjustable rates pass on the full impact of repo rate hikes, the rates are lower for new borrowers because of reduction in spreads. HDFC’s home loan rates had dropped to a low of 6.7% just over a year earlier. HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure.

Repo is the rate at which Reserve Bank of India lends funds to commercial banks when needed. This is the third hike since the beginning of the current financial year, taking the rate is back to pre-pandemic levels in order to tame the inflationary pressure. The non-banking finance company’s best rates are available only for applicants with credit score of 800 and above. Borrowers with a credit score below this cutoff will have to pay anywhere between 8.95% and 9.30% interest on home loans. The monthly EMIs that will be debited from your bank account also increases as the interest rate on your home loan increases.

FLIP offers a customized solution to suit your repayment capacity which is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in proportion to the income. The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan. Check with the lender if the property that you have shortlisted will be considered for a housing loan. Improve your credit score by creating a reasonable track record of timely repayments so that you achieve a high credit score which would improve your prospects of getting a home loan. You can download account statements, interest certificates, request for home loan disbursement and do much more.

Choose a home loan provider who is transparent w.r.t. processing fee and other related charges. Both State Bank of India and ICICI Bank the two largest mortgage lenders have increased their home loan rate by 35 basis points post the latest RBI hike on December 7. Home Development Finance Corporation Ltd has hiked its Retail Prime Lending Rate by 35 basis points with effect from December 20, 2022. HDFC home rates to start from 8.65 % onwards for credit score of 800 & above.

In the case of loans for resale homes, EMI begins from the month subsequent to the month in which disbursement of the loan is done. In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed. The EMIs will proportionately increase with every partial disbursement made as per the progress of construction. If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. With minimal documentation, applying for a HDFC home loan is quick and hassle free.

Now, the home loan rates for HDFC will start from 8.65 per cent for credit scores of 800 and above. HDFC provides a facility to apply online for a home loan through a secured platform on the website that customers can access from the comfort & safety of their homes or office. You will be taken to the loan application form where the details you have already provided will be prefilled. Fill in the balance details – your date of birth and password and click on ‘Submit’.

It is a warm little corner in the world that is yours, tailored by your tastes and needs. It is the place where you celebrate the joys and enjoy the journey called life. There is no place like 'home' and with HDFC Home Loans you can gather hopes, achieve your dreams and create memories in your own space. The Pradhan Mantri Awas Yojana -Housing for All was a mission that was launched by the Government of India with the aim of boosting home ownership. The PMAY scheme caters to Economical Weaker Section /Lower Income Group and Middle Income Groups of the society, given the projected growth of urbanization & the consequent housing demands in India. It is a loan to extend or add space to your home such as additional rooms and floors etc.

With the latest hike HDFC customers, new as well as existing, will have to pay 8.65% interest on home loans. You can prepay your home loan before the completion of your actual loan tenure. Please note that while there are no prepayment charges on floating rate home loans unless the same availed for business purposes.

Nearby HDFC Bank Branches

Transferring your outstanding home loan availed from another Bank / Financial Institution to HDFC is known as a balance transfer loan. You can submit a request for the disbursement of your loan online or by visiting any of our offices. You can take disbursement of your home loan once the property has been technically appraised, all legal documentation has been completed, and you have made your down payment. Loans against property / Home Equity Loan for Business Purpose i.e. Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer.

You may be eligible for tax benefits on repayment of the principal and interest components of your Home Loan as per sections 80C, 24 and 80EEA of the Income Tax Act, 1961. Since the benefits may vary each year, please do consult your chartered accountant/ tax expert for the latest information. With this option you get a longer repayment tenure of up to 30 years.

No comments:

Post a Comment